🔥 Pinescritlabs

Ctrader Store indicators: 🤖Pinescritlabs Ctrader Store cBots:

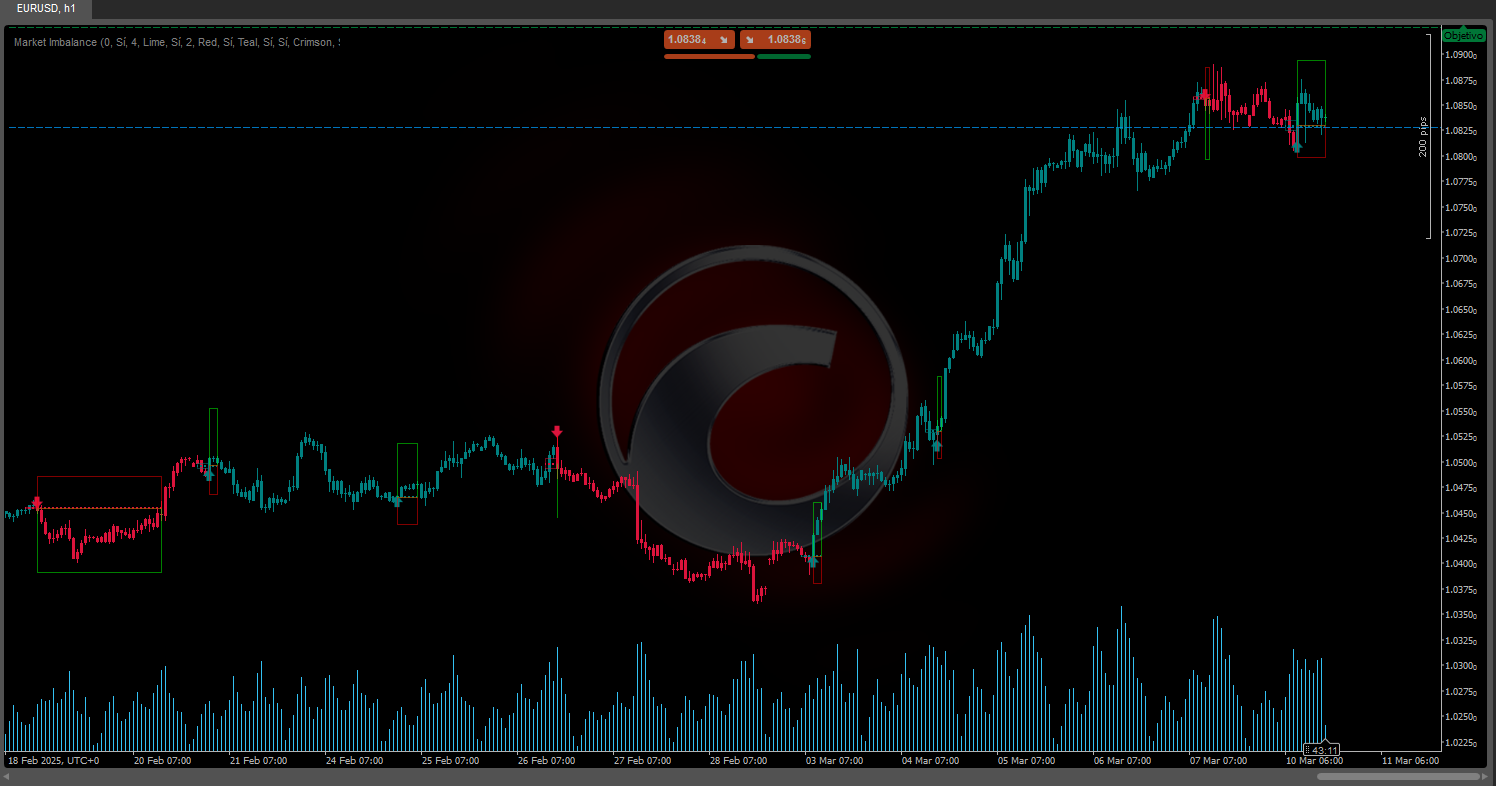

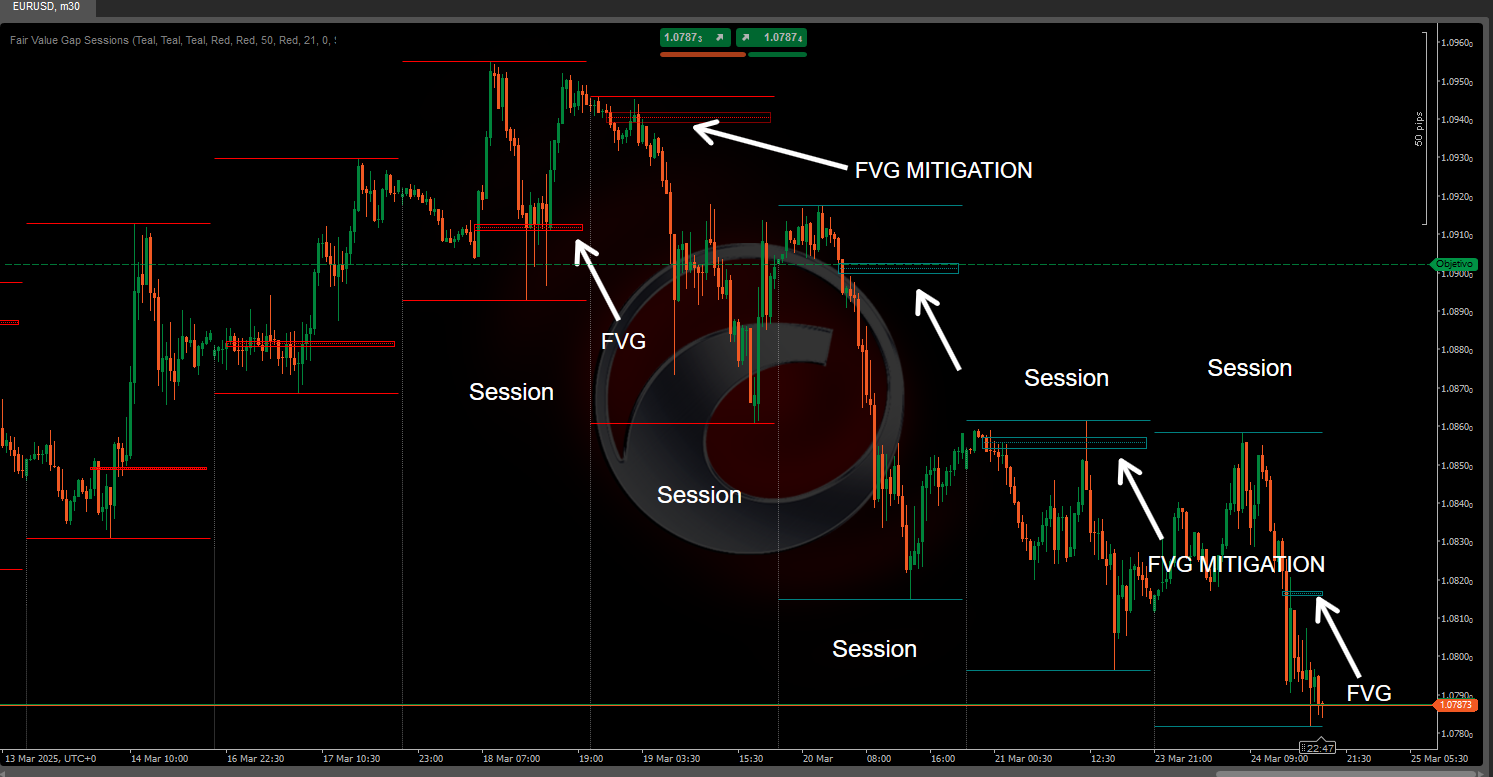

Fair Value Gap Sessions Gold & BTC Breakout Session Pivots

Dynamic Market Structure

Analysis of Turning Points

Fibonacci Linear

Regression Multi-timeframe

Multi-Level Candle Bias

Tracker

Auto Support and

Resistance Trend Lines

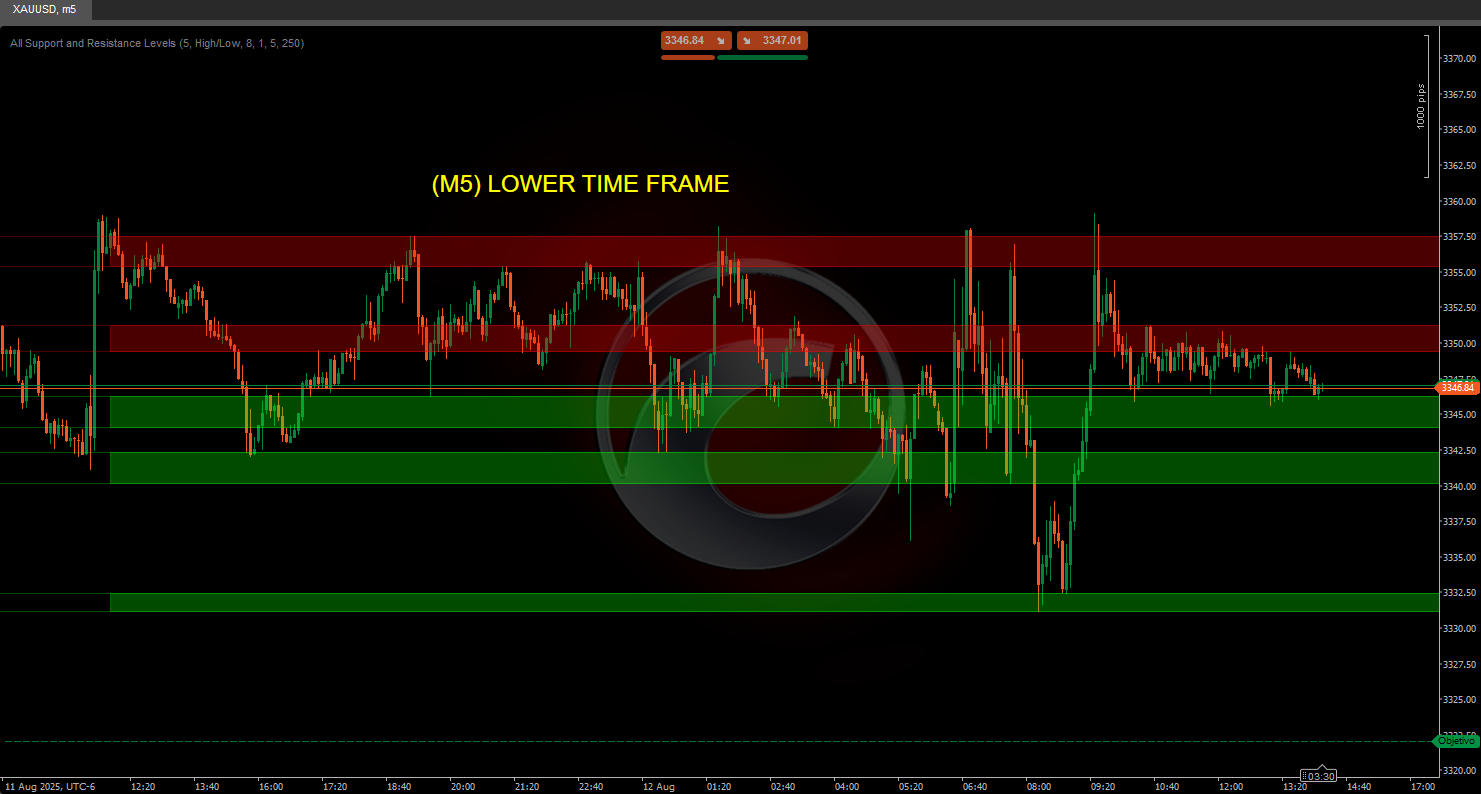

All Support and

Resistance Levels

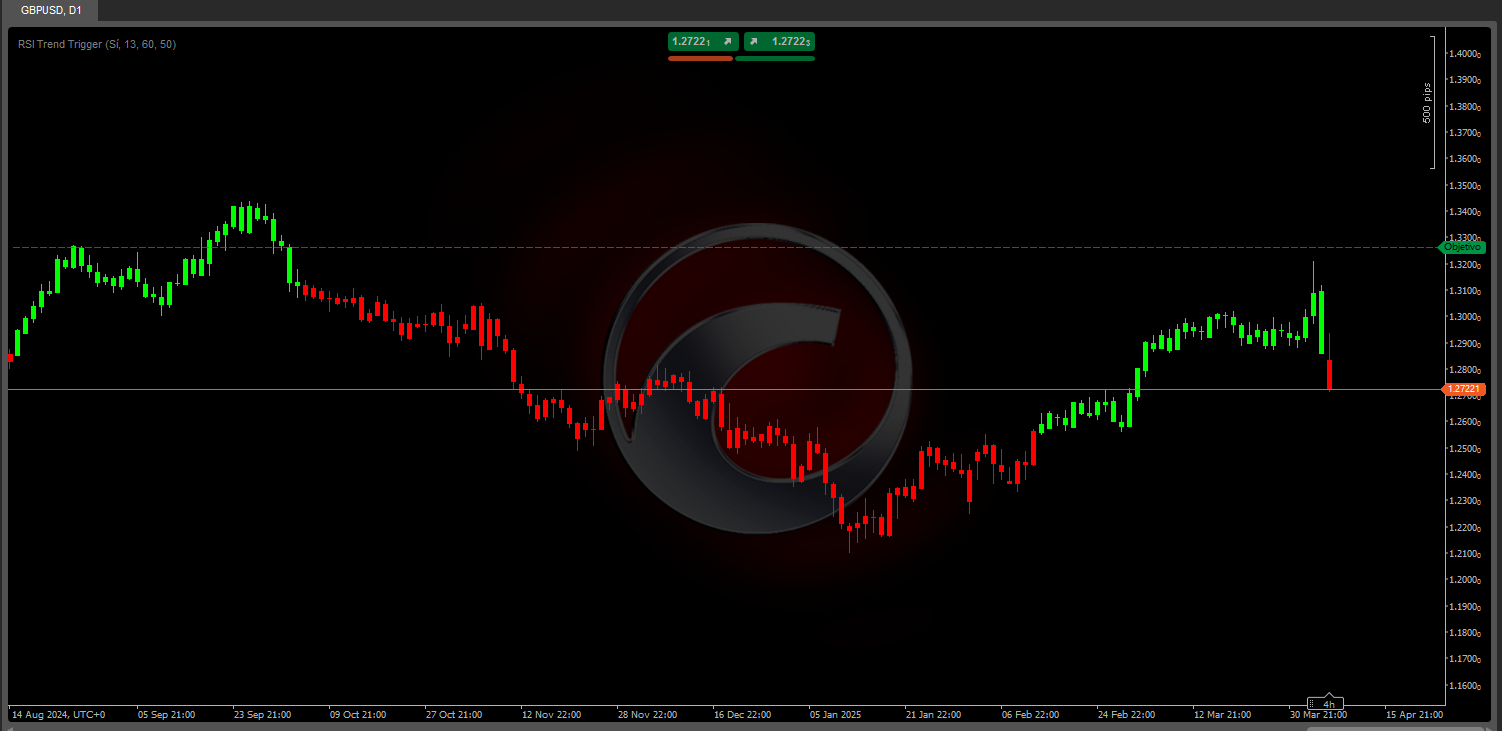

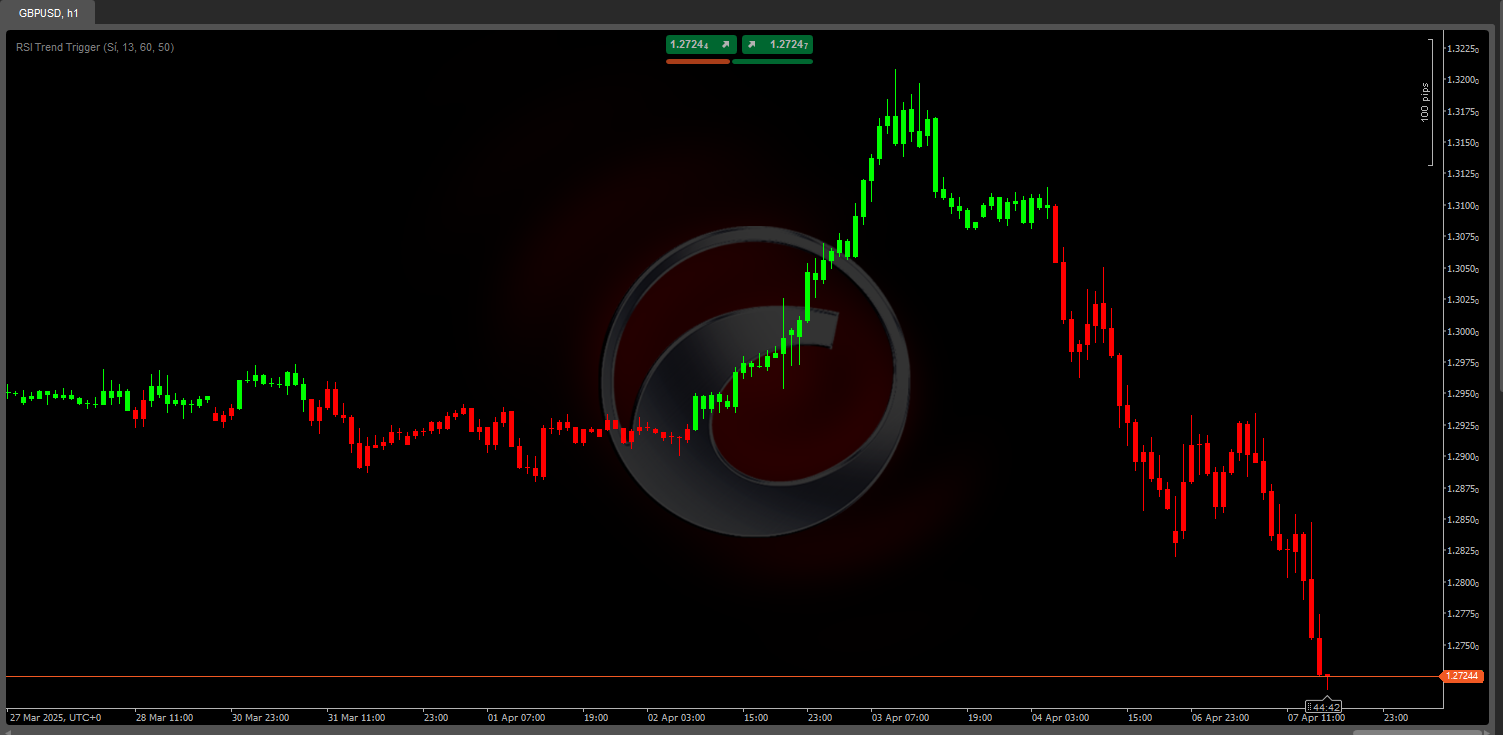

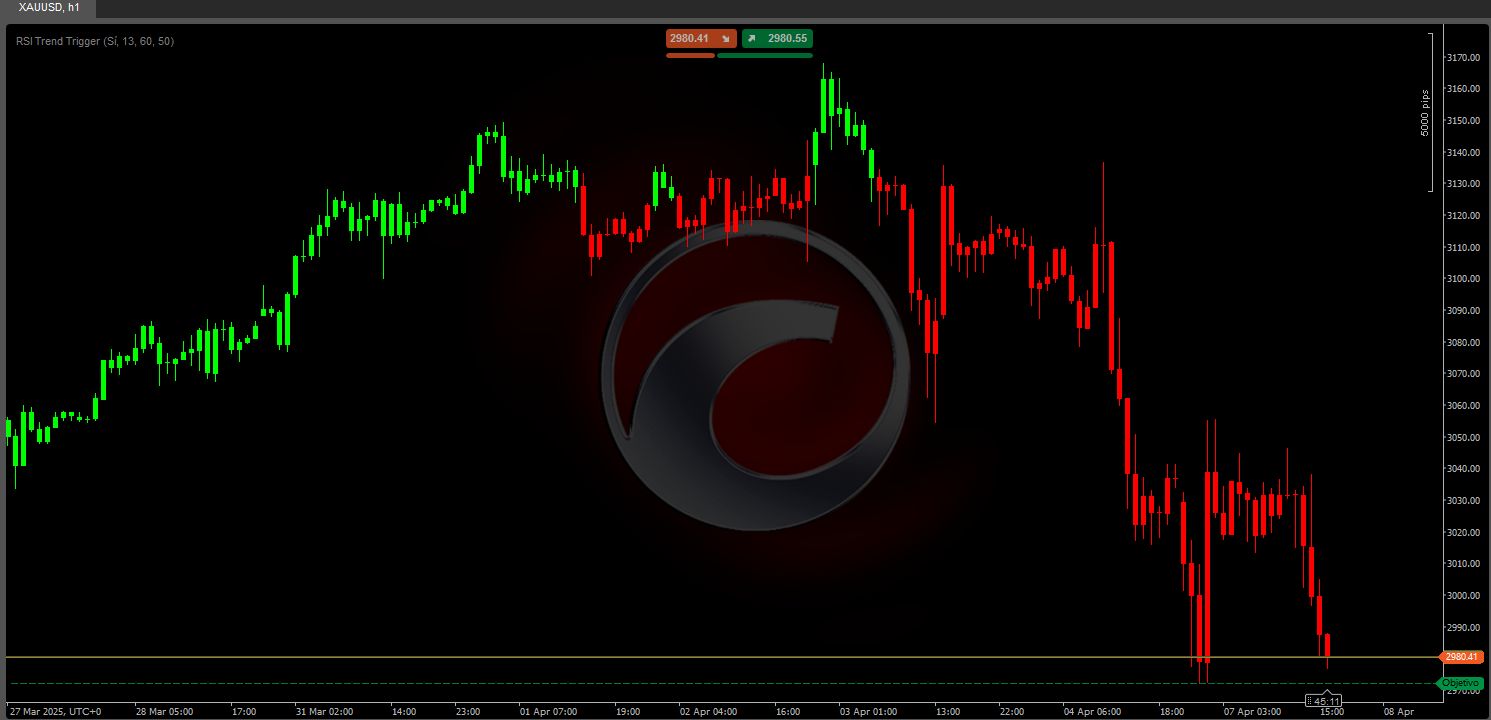

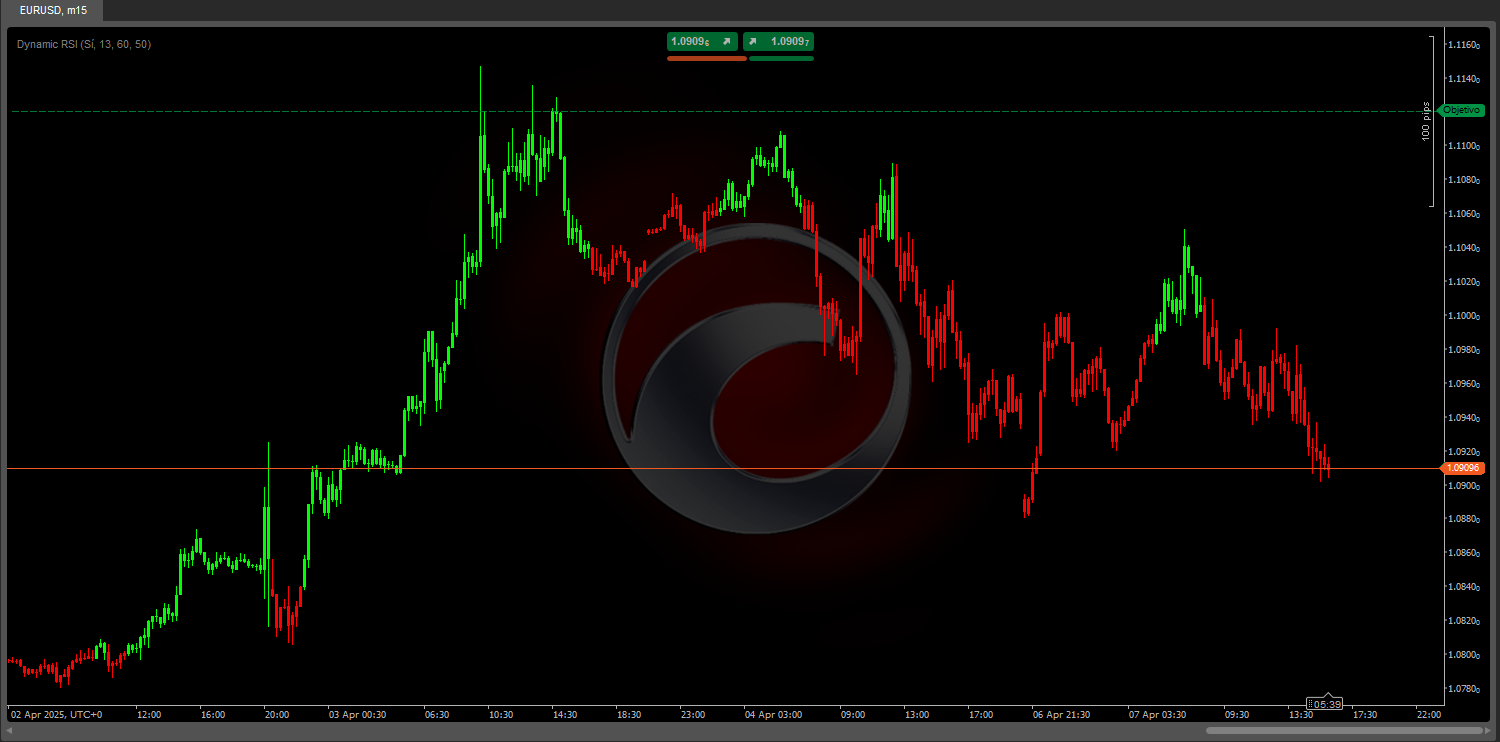

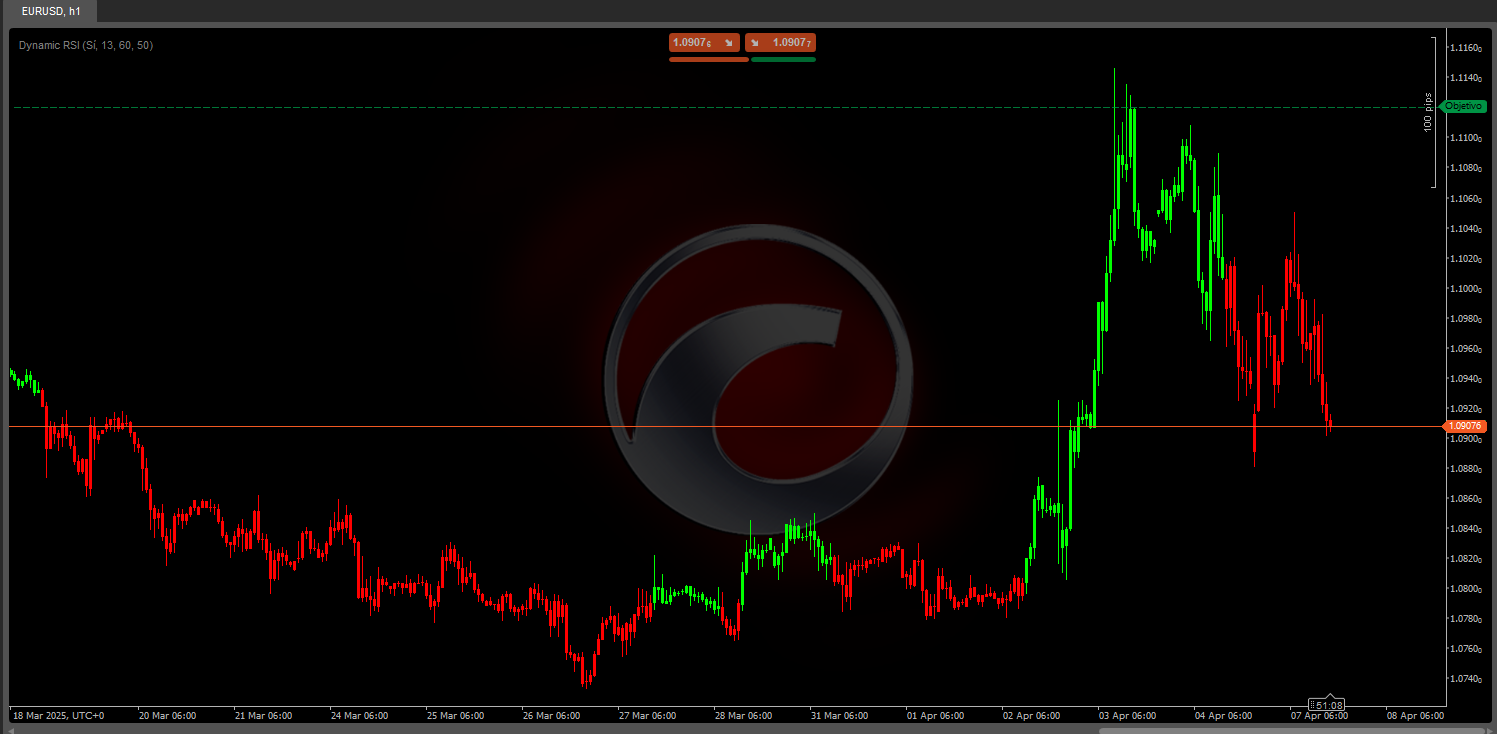

RSI Trend Trigger 📈✨

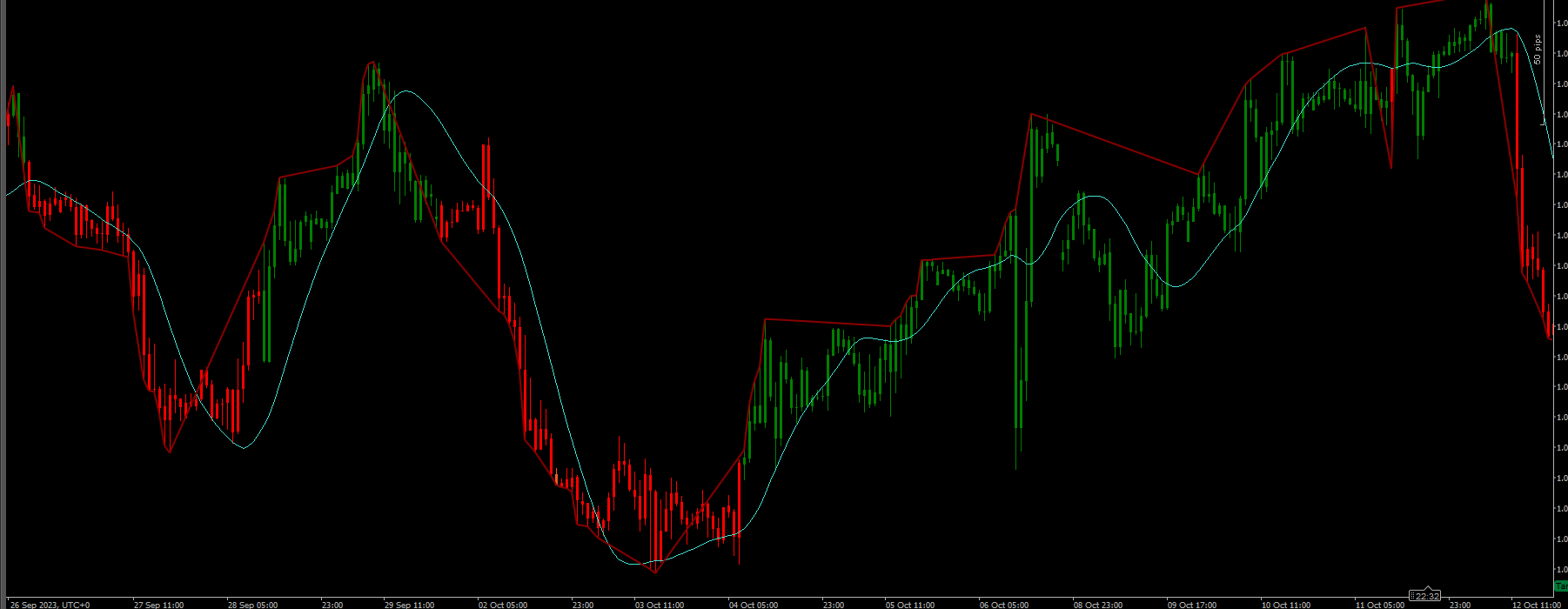

How Does It Work? 🤔

Step 1: Traditional RSI

The standard Relative Strength Index (RSI) is calculated, measuring the speed and magnitude of price movements over a set period. It oscillates between 0 and 100, identifying overbought conditions (e.g., above 70) and oversold conditions (e.g., below 30). 📊📉📈

Step 2: Dynamic Refinement

The traditional RSI undergoes an advanced smoothing process:

- A second mathematical calculation is applied to the original RSI values (not the price itself).

- This step creates a more stable version of the RSI, reducing minor fluctuations (market noise) and highlighting genuine trends.

- Unlike basic smoothing, this method preserves responsiveness to significant momentum shifts, avoiding excessive delays. 🛡️🔄

Why Does the Refinement Matter? 🤩

- Smart Filtering: Eliminates false signals caused by temporary volatility, such as news spikes or speculative moves. �🗑️

- Sharper Trends: The dual-calculation approach distinguishes between minor corrections and real trend reversals. 🎯

- Persistent Signals: Once a trend (bullish/bearish) is confirmed, the indicator holds it until a clear reversal occurs, avoiding erratic signal jumps. 🔒

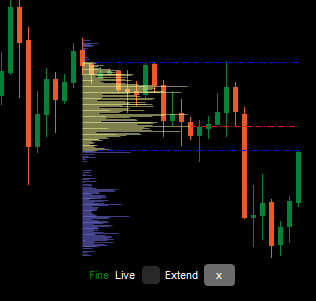

Practical Use: Thresholds & Decision-Making 📈

The refined RSI combines with two adjustable thresholds:

- Bullish Threshold (e.g., 60):

- If the refined RSI crosses above this level, a bullish trend is confirmed. 🚀

- Candles turn green

- Bearish Threshold (e.g., 50):

- If the refined RSI drops below this level, a bearish trend is triggered. 📉

- Candles turn red

Key Rule:

- Signals only appear during trend changes (not on every fluctuation), reducing information overload. 🚫📢

- Thresholds are customizable: use higher values (e.g., 65/55) for volatile markets or lower values (e.g., 55/45) for smoother trends. ⚙️

Benefits for Traders 🏆

- Enhanced Precision:

- Fewer false signals thanks to dual-layer filtering. Ideal for sideways markets or fakeouts. ✅

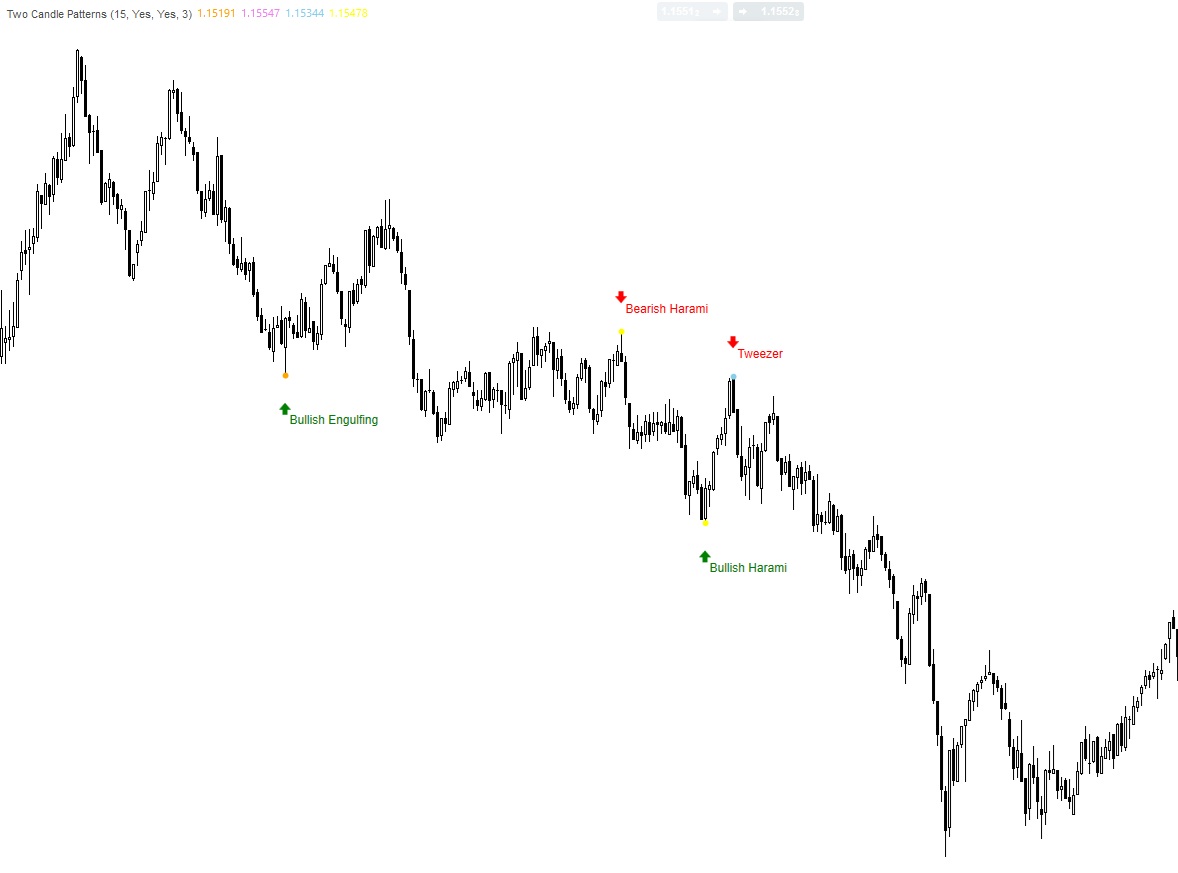

- Intuitive Visualization:

- Colored candles and visual thresholds let you spot trends instantly. 👀🎨

- Adaptability:

- Works across assets (forex, stocks, crypto) and timeframes (minutes to weeks). 🌍⏳

- Trend-Focused Trading:

- Helps trade with the momentum, avoiding risky counter-trend moves. 🎯🚦

Example Signal Flow

Imagine the refined RSI is at 55 (neutral zone):

- Bullish Scenario: Rises to 62 → Crosses the 60 threshold → Candles turn green🚀

- Bearish Scenario: Drops to 48 → Breaks the 50 threshold → Candles turn red📉

.png)